colorado estate tax threshold

Inheritance tax is a tax paid by a beneficiary after receiving inheritance. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance.

Polis Colorado Legislators Push 700 Million In Property Tax Relief That Taps Into Tabor Refund Subscriber Only Content Gazette Com

The following are the federal estate tax exemptions for 2022.

. In general the tax does not apply to sales of services except for those services specifically taxed by law. You are required to file a federal income tax return or. The credit amount is adjusted by inflation each year.

In its first fifty years the state income tax had graduated rates where higher income earners were subject to higher tax rates than lower income earners. The credit amount is adjusted by inflation each year. The department will consider among other things.

Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim this. House Bill 1312 raises that threshold to 50000. The right estate planning lawyer can help to evaluate your situation.

CO ST 39-235-103. 1 Benefits to Using Lifetime Gift Tax Exclusion Early. As of January 1 2012 the exclusion equaled the federal estate tax applicable exclusion amount so.

In 2010 Vermont increased the estate tax exemption threshold from 2000000 to 2750000 for decedents dying on or after January 1 2011. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. Colorado states across the US.

5 big tax bills Colorado lawmakers passed this year that will affect your wallet. A retailer will only qualify for origin sourcing if the retailers total retail sales of tangible personal property commodities. Tax is tied to federal state death tax credit.

Download the Corporate Income Tax Guide. You have a Colorado income tax liability for the year. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF.

The taxpayers net Colorado tax liability minus all credits withholding and any sales tax refund is less than 1000. A nonresident of Colorado with Colorado source income AND. The maximum unified credit allows a person who died in 2020 to gift up to 1158 million during his or her lifetime without paying gift or estate taxes.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. 2 The lowest tax rate for those whose estates total just beyond the 1206 million tax rate is 18. Nonresident real estate withholding DR 1079.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. The maximum unified credit allows a person who died in 2015 to gift up to 543 million during his or her lifetime without paying gift or estate taxes. However if the decedent owned any sort of real property the estate must apply for normal probate.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. The tax applies generally to every C corporation that is organized or commercially domiciled in Colorado and to every C corporation that has property payroll or sales in Colorado in excess of certain thresholds. Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment.

A part-year resident of Colorado will complete the Colorado Individual Income Tax Return DR 0104 and the Part-Year Resident Tax Calculation Schedule DR 0104PN to determine what income will be claimed on the DR0104 form. Individuals can exempt up to 117 million Married couples can exempt up to 234 million The annual gift exclusion is 15000 These values may also be impacted by gifts that you make during your lifetime. Colorado imposes a tax on the income of any C corporation that is doing business in Colorado.

One of the new laws HB-1311 will eliminate certain state tax deductions for individuals and households with higher. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is 50000 or less in total actual value. The Estate Tax is a tax on your right to transfer property at your death.

Part-year residents will initially determine their Colorado taxable income as though they are full-year residents. The unified credit applies to both federal gift tax and estate taxes which are integrated into one unified tax system. 1 Most individuals and non-corporate businesses are subject to the tax.

Please submit completed declaration schedules to the Colorado county assessors office in which the property is located as of the January 1 assessment date. Whose tax payments may increase. Businesses would see a big increase in the dollar threshold of personal property and equipment that is exempt from taxes.

Do you make more than 400000 per year. If an estate is worth 15 million 36 million is taxed at 40 percent. The taxpayer was a full-year resident for the preceding tax year which consisted of 12 months and the taxpayer had no net Colorado tax liability for that tax year.

The unified credit applies to both federal gift tax and estate taxes which are integrated into one unified tax system. The state of Colorados single largest source of revenue the individual income tax was enacted in 1937. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income.

A Colorado resident is a person who has made a home in Colorado or a person whose intention is to be a Colorado resident. Colorado imposes sales tax on retail sales of tangible personal property. That 40 rate is the top tax rate and it only applies to families leaving behind more than 1 millionafter accounting for the lifetime gift tax exclusion.

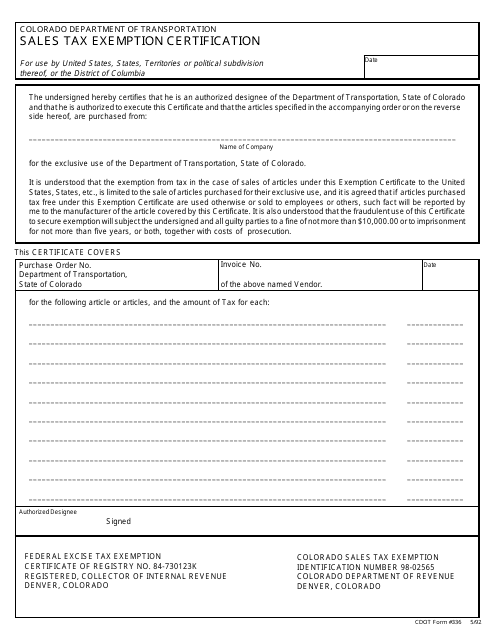

Cdot Form 336 Download Printable Pdf Or Fill Online Sales Tax Exemption Certification Colorado Templateroller

Understanding Section 2032a Special Land Valuation Under New Tax Plans

Colorado Gift Tax The 1 Planning Opportunity

State Estate And Inheritance Taxes Itep

New Irs Requirements To Request Estate Closing Letter

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

State Estate And Inheritance Taxes Itep

Tax Exemption For Period Products Diapers Passes Colorado Legislature Subscriber Only Content Gazette Com

Estate Tax Protection Attorney Castle Rock

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

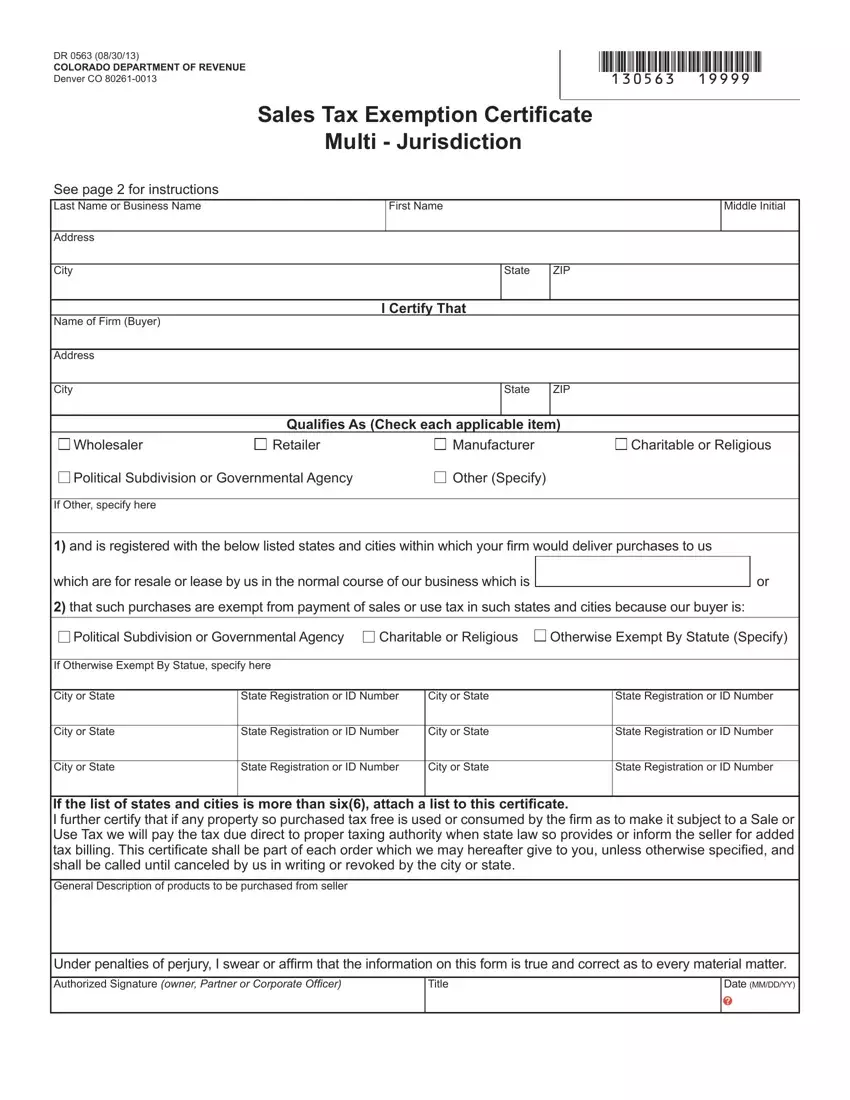

Colorado Exemption Form Fill Out Printable Pdf Forms Online

State Estate And Inheritance Taxes Itep

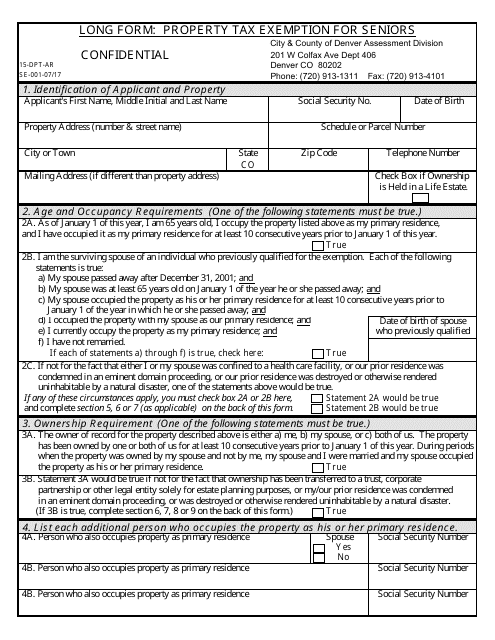

Form 15 Dpt Ar Download Printable Pdf Or Fill Online Long Form Property Tax Exemption For Seniors Colorado Templateroller

Colorado State Taxes 2022 Tax Season Forbes Advisor

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans